Economic headwinds: Financial institutions

ARTICLE | September 30, 2022

Authored by RSM US LLP

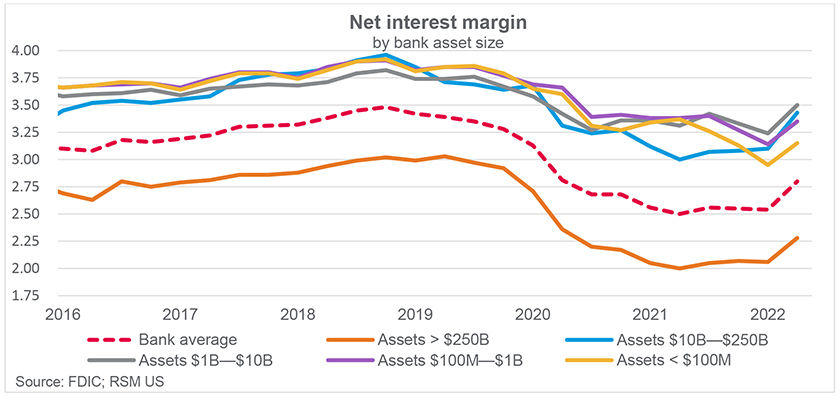

The financial institutions ecosystem is in a unique position as the economy works through the current inflationary phase. The Federal Reserve has embarked on an aggressive rate hike campaign as it normalizes monetary policy, with the high likelihood of further hikes yet to come over the remaining meetings in 2022. So far, these hikes have had a mixed impact on the industry. On a positive note, financial institutions have been operating for a long time in an environment with historically low interest rates, and they’re reacting to the hikes with guarded optimism. On the negative side, they’ve been relishing the low cost of funds, which will soon be in the rearview mirror as deposit repricing is underway.

Although the rise in interest rates will clearly benefit financial institutions by lifting net interest margins, leadership teams should be cognizant of the potential undesirable impact the unfolding macro picture will have on their organization. These economic impacts aren’t just limited to credit deterioration. They will also affect deposit balances with spillover effects affecting headcount and compensation and even those tied to service providers as management will look to control costs.

With the Fed committed to its current monetary policy course, financial institutions will need to be vigilant in their monitoring of internal conditions and external forces to ensure the impact of any economic downturn is minimal.

A top challenge for financial institutions in a slowing economy is managing loan portfolios

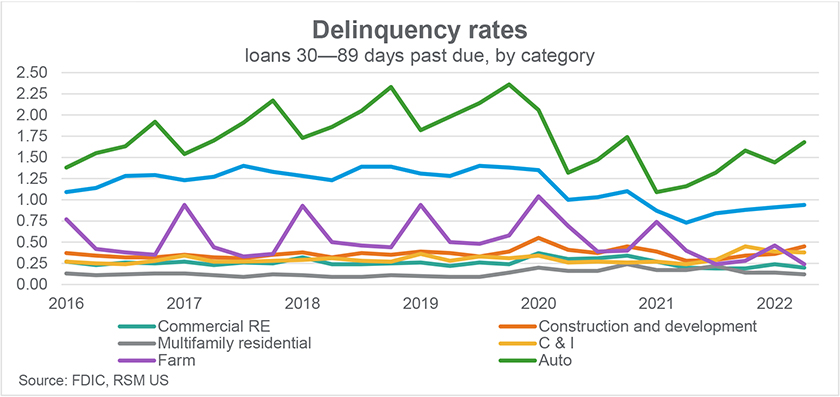

Escalating interest rates and related price differentials that show up in the net interest margin won’t be the biggest challenge for financial institutions. Rather, organizations will need to manage the health of their loan portfolios. These portfolios and their underlying credits have remained very strong in the past few years. The industry has successfully weathered the pandemic and worked through a stretch of multiple quarters with surprisingly low provision expenses, and some institutions even had negative provisions. While this may have resulted in a nice boost to earnings for some institutions, with a potential recession looming, staying in close contact with borrowers and monitoring the health of credits will be of utmost importance as early-stage delinquencies in certain loan categories begin to increase.

With the Fed actively engaging in policy normalization to slow economic activity, there will be an impact to some borrowers’ ability to repay their debts. Consequently, if loan officers are not proactive in their communication with borrowers about expectations and financial conditions, financial institutions will experience a rise in net charge-offs and see a direct impact on their bottom line as the charge-offs eat away at earnings. Borrowers to focus on include those tied to housing, those involved in select segments of commercial real estate and those with significant inventory levels that may now be faced with slashing product prices in light of rising input and operating costs.

Other challenges for financial institutions include labor supply and turnover

Attracting and retaining skilled labor continues to be a major issue for financial institutions, and inflation has amplified it. Data scientists, information technology specialists and people who work in similar roles are often more interested in industries outside of banking. Many such workers are taking advantage of the spike in wages due to inflation and jumping ship to other industries in which they can earn more money.

Compared to other industries, financial institutions are affected to a greater extent by this turnover, which is driving up institutions’ training costs. For example, a teller position is one that requires essential training during the onboarding process due to rules and regulatons related to handling money. Turnover in this position leads to an increase in training costs; this is just one example—among many—of an unsuspected result of inflation. This cost increase combined with other more obvious inflationary expense increases, such as the rise in price of supplies, energy, rent and services, will raise operating expenses incurred and drive earnings down even further.

How financial institutions are mitigating the impacts

Process automation—where applicable—can be a huge factor in mitigating these challenges. The pandemic accelerated digital transformation within the industry and many more individuals use mobile apps and online banking tools than ever before. In North America, installations of fintech apps grew 69% year over year in 2021 compared to 2020, according to analytics platform company Adjust’s mobile app trends report for 2022; of that growth, 34% is directly attributed to banking apps. Financial institutions can adjust to the lack of labor and the related hardships by investing in their infrastructure and technologies that will allow automation, which will help ease the burden of tight labor supply as well as ensure that their digital capabilities are up to par to better serve their customers.

Smaller and midsize financial institutions have historically struggled in terms of process automation adoption due to the limitations of their size, but this could be a reason to explore mergers and/or acquisitions. A lot of companies that fall within these categories are looking for merger opportunities to make their transformation into digital banking a success.

By the numbers: Delinquencies

While financial institutions have weathered the pandemic and maintained healthy capital positions and strong credit, cracks in the system may be forming as early-stage delinquencies begin to surface in select pockets of loan portfolios. While credit card and auto delinquencies began to rise earlier in the year, the chart below shows that construction and development loans are starting to show signs of stress.

This article was written by Brandon Koeser, Angela Kramer and originally appeared on Sep 30, 2022.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/financial-institutions/economic-headwinds-financial-institutions.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Pugh CPAs is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Pugh CPAs can assist you, please call 865.769.0660.

Let's Talk!

Call us at 865.769.0660 or fill out the form below and we'll contact you to discuss your specific situation.