ESG in supply chains: Summer 2022

OUTLOOK | May 25, 2022

Authored by RSM US LLP

Middle market leaders are increasingly looking beyond the Friedman doctrine by including practices and policies related to environmental, social and governance issues throughout their business to increase their companies’ value. Many manufacturers already have well-rooted practices that acknowledge responsibility for environmental and social issues, including diversity, equity, and inclusion and, more broadly, social justice awareness. But as ESG issues become more important to employees, shareholders and customers, leaders need to ensure they are mindful of ESG violations in their domestic and global supply chains. Such infractions can involve issues ranging from geopolitical conflicts and unethical labor practices to sourcing strategies that violate human rights.

Upon further investigation, more and more business leaders have recognized that having an ESG framework or values in place can—in addition to mitigating risk—have meaningful benefits for their stakeholders and society as a whole. Manufacturers that have not yet addressed how ESG issues fit throughout their enterprise should embark on a plan to do so, especially as these issues relate to sourcing and supply chains.

Geopolitical risks raise ESG stakes

Although the world has experienced geopolitical unrest throughout history, current world events continue to wreak havoc on fragile global supply chains. The Russia-NATO conflict, major cyberattacks and the decoupling of technology between the United States and China are the top three risks highlighted in the most recent BlackRock Geopolitical Risk Indicator, which lists the top 10 such risks by likelihood from high to low.

This plethora of geopolitical issues has made leaders unavoidably focused on understanding the legitimacy of international governmental practices and actions in the countries from which their products are sourced, the ethics of their suppliers’ labor practices, and potential stakeholder scrutiny of goods supplied from particular countries or regions—e.g., oil from Russia.

Controversial sourcing

One of the most holistic examples of the prevalence of ESG issues throughout the supply chain is manufacturers’ dependence on rare earth elements. As outlined in a 2021 White House executive order on the nation’s supply chains, manufacturers rely heavily on sourcing of a variety of minerals and metals, including copper, lithium, nickel, cobalt, graphite and magnesium, from a limited number of countries. U.S. manufacturers of computer hard disks, cell phones, solar panels, wind turbines, batteries, lasers, gas turbine engines or catalytic converters for automobiles, among others, have become largely dependent on other countries for mining, processing and transporting of these rare earth elements.

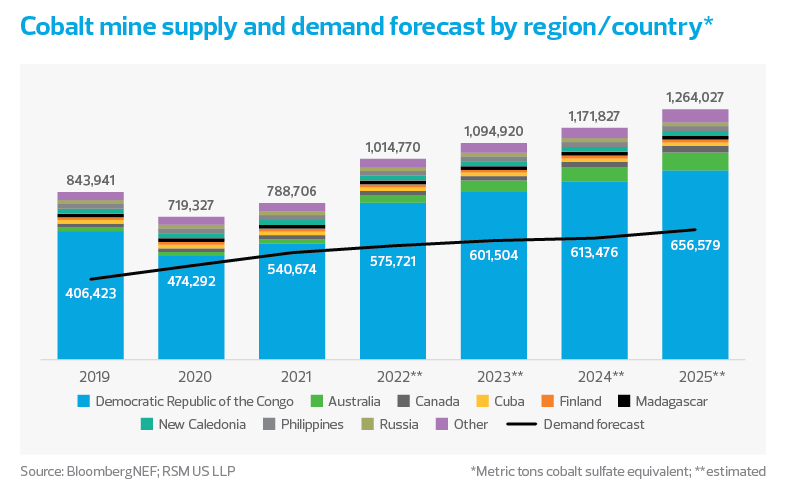

For industries with dependencies on rare earth elements, ESG concerns arise throughout the production process. For example, approximately 70% of the world’s cobalt—used to make lithium-ion batteries—is mined in the Democratic Republic of Congo, where mining practices involve manual, high-risk methods and at times child labor. Companies should evaluate the ethical and labor implications of these practices alongside environmental issues, not to mention the carbon footprint of shipping these minerals from the source country to refineries to the final customer. While there are no easy solutions, this example represents the first step in embracing ESG—awareness. Given efforts to increase traceability, it will become increasingly important to understand not only a material’s source country, but also the company that mined it and that company’s labor practices.

Similarly, China, currently the supplier of approximately 90% of the world’s rare earth elements, has been known to use labor practices that violate human rights—as the U.S. Department of State and others have reported—and environmental practices that have harmful outcomes, such as the Inner Mongolia toxic lake formed by the output of the rare earth refineries nearby.

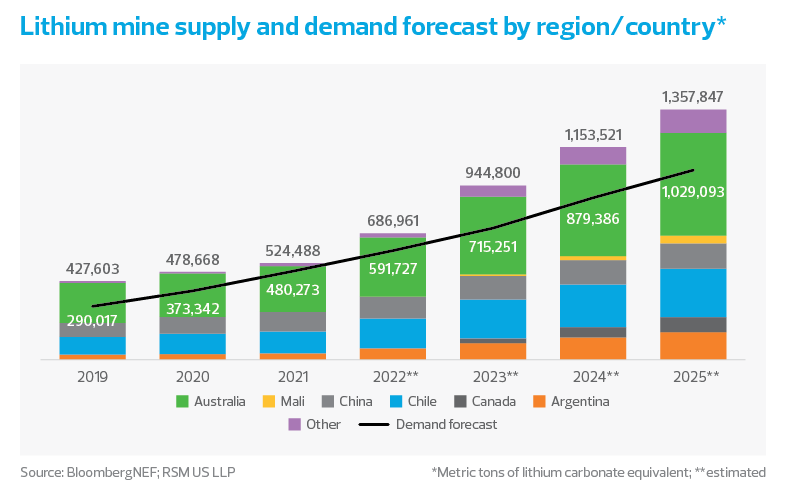

For lithium, there are risks in sourcing the material because it is largely provided by only four countries—Australia, Chile, China and Argentina. Of greater concern is the process for mining and refining lithium, which requires enormous quantities of water. This water usage raises concerns about the impact of the process on the environment, which can include water supply issues, destabilization of the surrounding earth, soil contamination and toxic waste.

As social awareness of these and other issues increases, middle market manufacturers will need to understand the impact on how customers and other companies perceive their brand.

Along with general awareness and sensitivity around ESG issues, manufacturers need a thorough understanding of their suppliers’ and subsuppliers’ supply chains and the potential ESG risk exposure they present in everything from raw material procurement through production, and ultimately through the life of the end product.

Manufacturers in the automotive industry are already acknowledging that recycling can and will be part of their supply chain of the future for certain rare earth elements and are taking responsibility in their planned sourcing and recycling of used EV batteries. In 2021, for instance, Ford announced their investment in Redwood Materials, a leading battery materials company, to address sustainability in EV batteries through recycling.

Middle market insight

As social awareness of these and other issues increases, middle market manufacturers will need to understand the impact on how customers and other companies perceive their brand.

Manufacturers also need to navigate a key reality when it comes to ESG strategies; it may not be possible to fully mitigate problematic labor, ethical and environmental issues immediately. Still, companies can and should begin on a path guided by ESG policies for the long term.

While large companies such as General Motors and General Electric are establishing ESG policies and frameworks, incorporating holistic corporate governance practices, and issuing annual sustainability reports, what can middle market manufacturing companies and others do to develop their own ESG strategies and policies?

- Communicate with vendors and suppliers at a more macro level. To fully understand the supply chain and where weakness and risk may be present, it is critical to go beyond the requirements of the initial procurement phase to know your supplier more broadly, including all aspects of their suppliers and their ESG practices. This includes having greater involvement within manufacturing ecosystems to build relationships and increase awareness of what others are seeing and how they are responding.

- Create a supplier scorecard reflecting desired attributes and metrics the company can use in its evaluation of supplier sourcing partners.

- Explore how to include ESG requirements and codes of conduct in contractual arrangements.

- Incorporate traceability into the supply chain from the point of origin through delivery to the end user. Citing tools to accomplish this, Harvard Business Review noted that blockchain technology “can greatly improve supply chains by enabling faster and more cost-efficient delivery of products, enhancing products’ traceability, improving coordination between partners, and adding access to financing.”

Prioritizing ESG issues in the supply chain is not only about doing what is right or mitigating all identifiable risks. Middle market manufacturers that have invested in ESG and developed robust ESG policies and procedures can reap several clear benefits. Through the relative transparency that ESG can provide to investors, consumers and markets, some companies have become more sought after because of the alignment of their policies with those of external constituents. This then leads to greater competitiveness in the market, along with increased brand and product reputation and recognition.

With the right planning and strategy, companies can harness these ESG frameworks to achieve improvements in quality, production efficiency, profitability and talent attraction.

This article was written by James Ward and originally appeared on May 25, 2022.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/manufacturing/esg-supply-chain-manufacturing-trends.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Pugh CPAs is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Pugh CPAs can assist you, please call 865.769.0660.

Let's Talk!

Call us at 865.769.0660 or fill out the form below and we'll contact you to discuss your specific situation.