Family office dream team

ARTICLE | February 08, 2022

Authored by RSM US LLP

Establishing a successful family office can be likened to forming an all-star team, where the strategy is to select the right combination of A-list players to achieve goals and win big. For many high net worth families, the objective of the game is to sustain multigenerational wealth, protect their legacy, and manage their personal affairs. A family office serves to help with all of this and more.

Key considerations for creating a family office include the entity's structure, size, and complexity, which the needs of the family dictate. The most successful family offices also exhibit the following elements:

- A solid governance framework – Provides structure around decision-making, command and control of the family office

- Stability and agility – Balances the achievement of initial goals against the evolving expectations of an intergenerational family

- Top talent – Hires the most qualified employees and professional advisors who can demonstrate the level of knowledge and industry focus necessary to support and advise the family on how to achieve operational excellence

- A collaborative environment – Creates an environment that fosters group decision-making that involves every functional area of the business, including external service providers

- Effective communication – Develops consistent protocols for how, when, and with whom information is shared to promote engagement

- Family involvement – Identifies family members who are a good fit for a role in the family office, or who can help provide oversight

Above all, a successful family office is designed to meet the family's continuously changing needs. Here's how to customize a profitable and efficient enterprise that can grow and evolve over time:

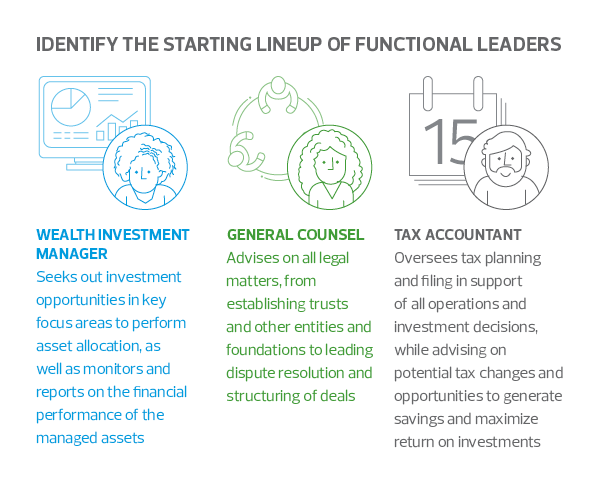

Identify the starting lineup of functional leaders

The following roles make up the elite team that oversees the family office's core capabilities. Without these three functional areas, the business cannot achieve its main mission of growing and transferring the family's wealth across generations.

Grow a support network of professional talent

As a family office scales, it should consider expanding its functionality to achieve operational excellence. The nature and number of these services will depend upon the needs and wants of the family.

- Family attorney(s) – Supports the general counsel by performing a range of legal services

- Financial reporting analyst – Audits financial statements and balance sheets and manages report submissions

- Certified public accountant(s) – Performs general accounting and finance tasks

- Insurance and risk manager – Protects the family's wealth and reputation by developing tailored solutions to safeguard assets and reduce exposure to risk

- Technical engineer – Creates technology efficiencies and enhancements throughout the enterprise

- Human capital consultant – Manages the office's talent acquisition process

- Concierge – Handles everything from travel arrangements and administrative tasks to running errands

- Sustainability officer – Evaluates and makes recommendations on impact investments and environmental, social and governance (ESG) initiatives

- Philanthropic director – Identifies charitable giving opportunities and manages nonprofit partnerships

- Knowledge and learning officer – Keeps family members informed and inspired while also helping prepare heirs for post-transition responsibilities

- Cybersecurity advisor – Implements data security controls to protect sensitive information

- Estate planner – Organizes records and beneficiary designations to protect the family's assets and personal property

- Records management officer – Provides safekeeping and secure access to critical personnel and family financial records

Determine value when making buy versus build decisions

One of the most significant decisions around establishing a family office is whether to buy or build the functional areas of the business. Building them in-house requires family office assets and employees to perform the work, whereas buying involves outsourcing specific tasks to a third party, such as a professional services firm.

The solution often comes down to trade-offs between capabilities and cost, which sometimes calls for a mix of internal and external services to balance best-in-cost with best-in-class. Collaborating with a qualified advisor—who has the tools and resources to assess critical processes, people and technology—can help reveal opportunities and strategize a winning game plan for success.

This article was written by Benjamin Berger, Bill Bijesse and originally appeared on Feb 08, 2022.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/services/family-office/family-office-dream-team.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Pugh CPAs is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Pugh CPAs can assist you, please call 865.769.0660.

Let's Talk!

Call us at 865.769.0660 or fill out the form below and we'll contact you to discuss your specific situation.